Welcome to Newsletter Operator!

In today’s edition:

How to grow your newsletter, by buying a newsletter

New podcast with the founder of Stacked Marketer

Lessons from selling $1M in B2B sponsorships

And more!

Let’s dive in…

Deep Dive

Today’s deep dive is a guest post from Michael Houck.

Houck’s newsletter on how to build, grow, and raise capital for your startup is read by 60,000+ founders.

I’m a big fan of his content, check out Houck’s newsletter here.

Houck will take over writing from here…

Last month I bought a newsletter, shut it down immediately, and rolled the subscribers into my own existing newsletter.

Why would I do that? Wouldn’t they all just unsubscribe?

In short, it was a test because I believe things will change in the newsletter world soon and I wanted to understand the viability of newsletter M&A as a strategy.

Right now newsletters are hot.

Starting one seems like a great idea to just about everyone I chat with, and each week I come across 1 or 2 new newsletters that actually do seem worth reading.

I went full-time on mine 5 months ago, and it’s grown to 60,000 subscribers in that time.

Beehiiv is fueling this — they’re now growing by $1 million ARR every 2 months.

And SparkLoop is making it easier than ever for newsletters to grow.

Newsletter ads are all over Twitter and Instagram.

You’re probably hearing people who have never been interested in newsletters before all of a sudden tell you they’re thinking about starting one.

Personally, I’ve been able to build a business up to an $800,000 annual run rate on the back of a newsletter over these 5 months.

But I expect we’re less than a year ahead of tougher times.

And a wave of newsletter M&A is coming at some point in 2024.

Wait… Why?

Simply: a lot of newsletters that don’t scale quickly enough will fail to attract enough advertisers to remain viable businesses.

Yes, we’ll see more ad dollars enter the space too. Existing advertisers may increase their budgets and new sponsors will try newsletters out.

But my hypothesis is that the rate at which newsletters are created will outpace the rate of incremental ad dollars that enter the market.

This is the definition of a bubble. The supply of ad inventory will be larger than the demand for ads.

First, we’ll see newsletter operators compete by lowering prices. Something’s better than nothing, right?

But eventually, these newsletter operators will begin to churn out. Their businesses won’t grow as large or as quickly as they need them to in order to justify the investment of time and capital.

At a minimum, they’ll be more open to moving on and offloading the business for a lump sum of cash now.

Most of these businesses won’t be big enough to justify attention from traditional private equity firms, but many of them will have engaged readers and quality systems for creating content.

Basically, prime opportunities for acquisitions.

And the best people to run them? Operators who already know the newsletter business.

So to prepare for that future I ran an experiment to see if acquiring a newsletter in my niche (startups) and rolling their subscribers into mine was a valid growth strategy, or if too many would churn out — meaning that I’d need to plan to keep any newsletters I acquire going on their own.

Finding a Target

To be clear, I wasn’t setting out to do this — I found an attractive opportunity and was opportunistic about it.

Matt has started doing a great job in this newsletter of highlighting attracting deals in the space, and there are other solid marketplaces as well.

But I didn’t use them.

My only requirement for this type of experiment was that the newsletter was within my niche — startups.

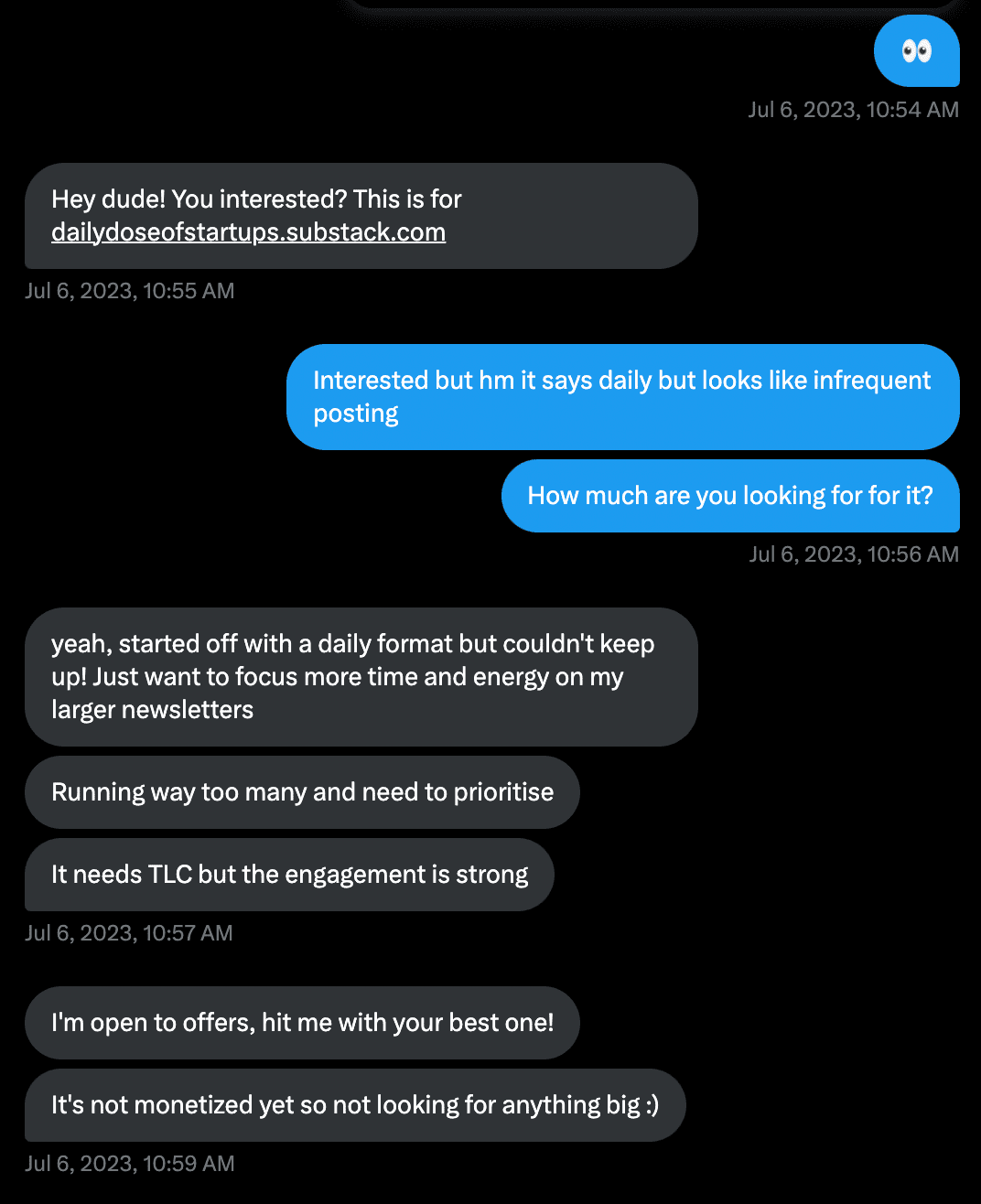

I found a post on X/Twitter from someone reputable who was looking to offload a small newsletter in my niche.

I knew Jaisal a little so I figured the negotiation would be friendly.

And given the size of the list I figured it was small enough to be worth a test.

Check check check.

The Acquisition

We went from initial DM to closing the deal in under an hour, but in that time I actually did do some diligence.

My first reaction was to be skeptical — the newsletter had been sent only a handful of times in the last 6 months, and sporadically.

Also, the content was basically just a list of links.

I questioned how engaged the audience would be due to the infrequent posting.

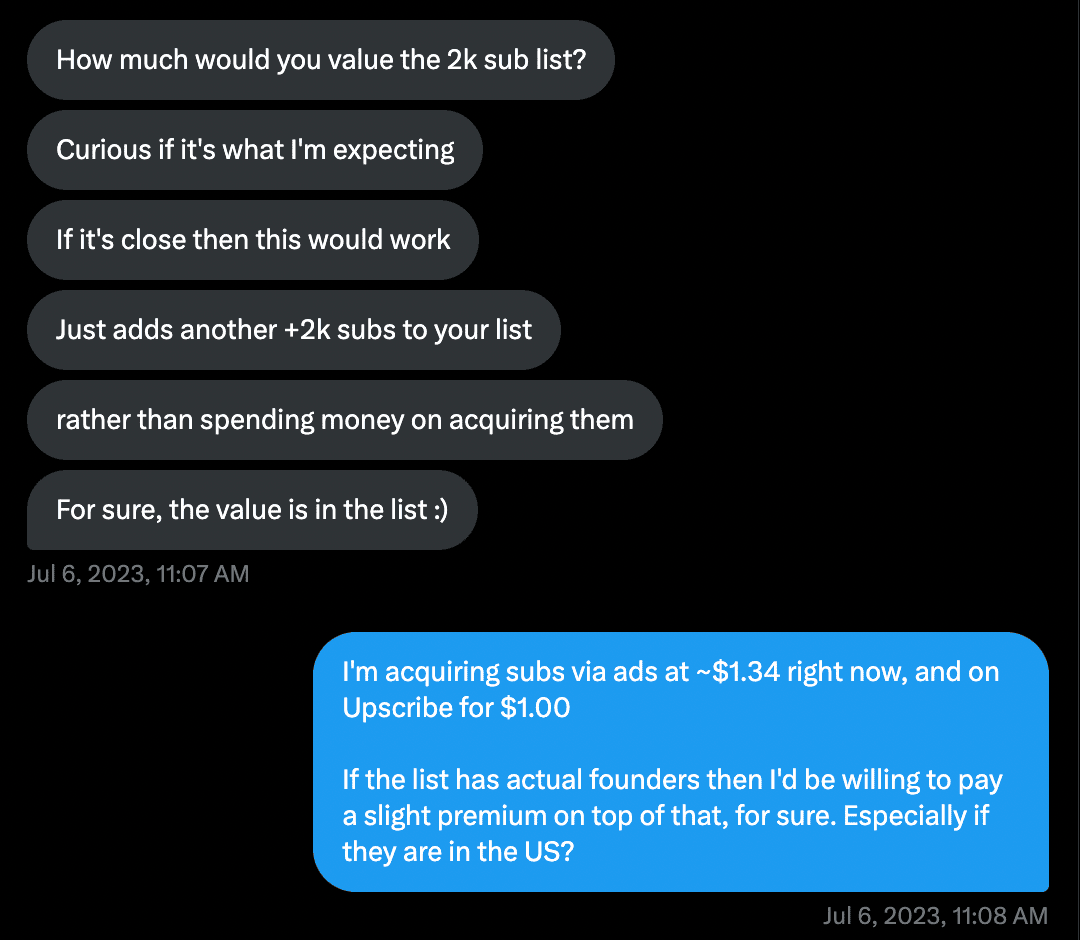

I quickly confirmed that I wouldn’t be interested in running a second newsletter myself right now. So the conversation turned to the value of the email list.

Since I wasn’t putting any value on the brand, I considered (in order):

List size

Subscriber geography (for potential monetization)

List engagement

Engagement was last simply because of the sporadic nature of the previous sends, and my plans to port it over to my own newsletter anyway.

He then sent over ~50 recent subs that I uploaded to my existing newsletter.

This let me get an estimate of what percentage of the subscribers would be net-new for me.

Thankfully 92% of this sample was new (and it turned out 89% of the full list was).

Lastly, Jaisal shared stats that confirmed with screenshots that the subscriber base was less US-focused than my existing list, though it did have some heavy-hitter founders in it.

So rather than offer a premium, I offered the same rate I was getting through ads — $1.34 per sub, for a total of ~$2,800.

He countered at $3,000 and I was happy to accept.

For him, this saved him the hassle of listing it on marketplaces — and for me the delta was small enough to not worry about.

Closing it Out

He shared the login for the existing Substack account.

Since the sale was so small we decided not to worry about signing any contracts or docs.

If you’re doing a larger acquisition I’d 100% recommend NOT doing this :)

He simply sent over his wire details along with the list and then I sent the money.

A day or two later he emailed the list from his domain informing them what was happening, and I onboarded them to my list.

We announced on Twitter later that day and that was that.

What’s Happened Since

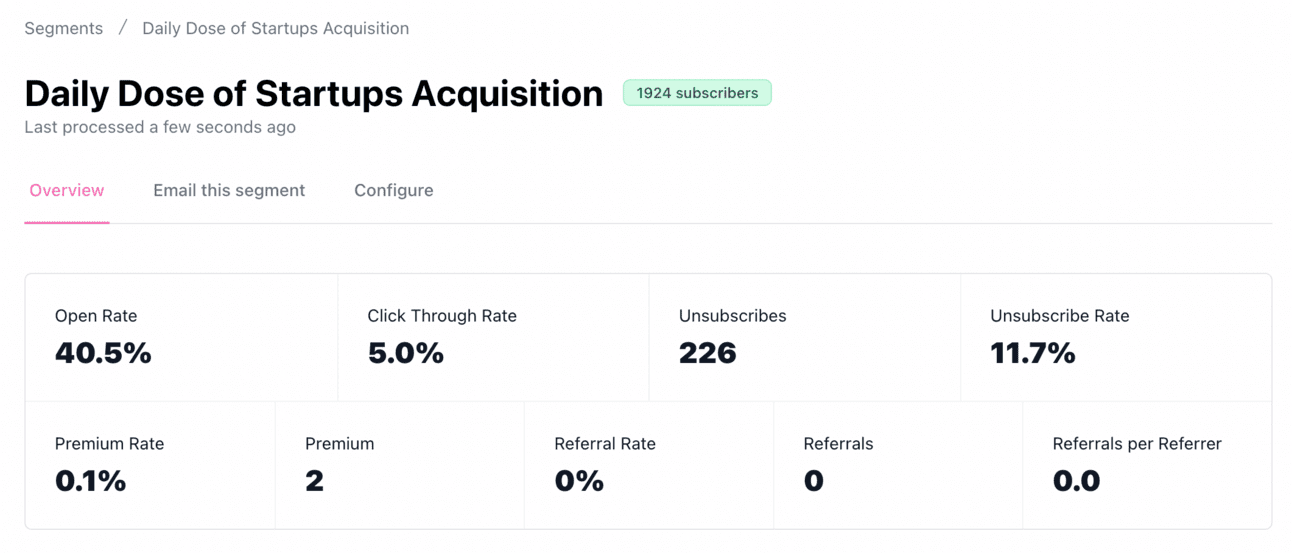

The jury’s still out on how valuable this will have been.

As of right now, here’s how I’d rate the metrics:

Open rate → Low but not awful

CTR → Ok

Unsubscribe rate → Better than I expected but still not great

Unsubscribe rate was the biggest unknown going into the acquisition.

If the audience alignment had been worse, I think this could have gone very badly.

As it were, I’d say it’s a mixed bag.

The net CPA (counting unsubscribes out) is now at $1.77. Not terrible by any means. But the cohort isn’t quite as engaged as I’d like.

Overall, looking ahead to 2024, M&A can be a valid growth strategy for established players — but only when the audience alignment is very high.

Back to Matt McGarry…

Thank you Houck for writing this post!

If you enjoyed this make sure to:

Follow Houck on Twitter

Subscribe to Houck’s Newsletter for free

The Best Links

📈 Growth

How Jack Butcher grew Visualize Value to 1.2M followers (link)

How Gunnar Holm grew a local newsletter to 10k+ subscribers (link)

💰 Monetization

Interview with Emanuel Cinca - How to build a $1.5M newsletter (link)

Lessons from selling ~$1M in B2B media at WorkWeek (link)

20 successful blogs and their 2023 revenue numbers (link)

👀 ICYMI

8 unconventional ways to grow your newsletter (link)

📰 Newsletter News

Atlas Obscura is on pace to hit $24M profitability through sponsorships (link)

BEFORE YOU GO

Get my free guide on how to grow your newsletter to 1,000+ subscribers in 30 days

Sign up to get instant access to the guide. Plus, more growth tactics, case studies, and industry news delivered to your inbox.

Join 60,000+ readers for free.